|

A Business Insurance Update

If you think about it, your business faces risks every day. When you open your doors, you have the risk of having sick or injured employees, customer complainants, and vendors who fail to deliver on their promises. The world has changed in the past few years and it is important for business owners to make sure their business insurance keeps up. Recently a large insurer released their annual business risk index. This index identified the top concerns of over 1,000 business owners. Nearly half of survey respondents believe that the business world is growing riskier, yet just 24 percent said that risk management was a strategic priority for them. According to the survey, the top seven worries of today's business owners across all industries are:

Let our agency help you understand how to manage and treat the risks. We offer a wide range of highly rated insurers that can offer the necessary products to help you manage you risks. Strive Insurance Group, Inc. is a full-service independent insurance agency that has been serving the insurance needs of the Dallas area since 1984. In addition to having a presence in the Dallas and North Texas area, we have also expanded to Austin and Central Texas with agent representation and the same professional service. A Texas Workers’ Compensation Update

There are over 4.1 million workplace injuries in the Unites States each year, according to OSHA. Employers spend about $155 billion on work related injuries each year. There is no doubt workers’ compensation is a big expense for employers. The good news is there are many actions an insurance agent can do to help employers reduce workers’ compensation costs.

As an Independent Insurance Agency we represent many insurance companies to fit your businesses dynamic needs. Whether you're a new business or a small business, we can help. Being an Independent Agent means we are not only your agent, but we are your insurance broker as well. We understand every business and industry is unique, so we will work with you to find the best business insurance coverage at the lowest rate. Contact us today for a free quote Your risks are constantly changing due to quick technology development, developing litigation concerns, a worldwide market, and rising product demand. We can better meet your specific needs thanks to our ground-breaking all-lines solution and expertise in risk engineering and claims.

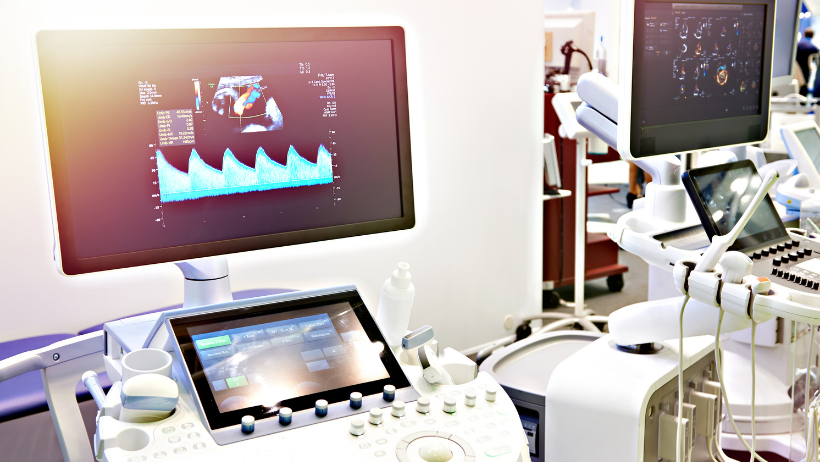

Because medical technology is advancing so quickly, it is essential to insure your products and equipment against the hazards that they pose. We have been assisting businesses with obtaining distinctive product liability insurance coverage for more than ten years, and we can assist you. You are subject to claims from third parties for bodily harm or damage to their property at any time because of your operations, your rendered operations (services), or your goods. This coverage covers, on your behalf, for the cost of defense and judgments that result from incidents that occur during your business (subject to policy terms and conditions). Medical device product liability insurance is intended to assist your company in covering third-party claims of property damage or physical injury. You could be held accountable if a blood pressure cuff malfunctions and causes harm to someone or if an exam light malfunctions and causes a fire. Insurance for general and product liability insurance should be insured, in addition, we provide coverage for.

|

Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed

8/30/2022

0 Comments