|

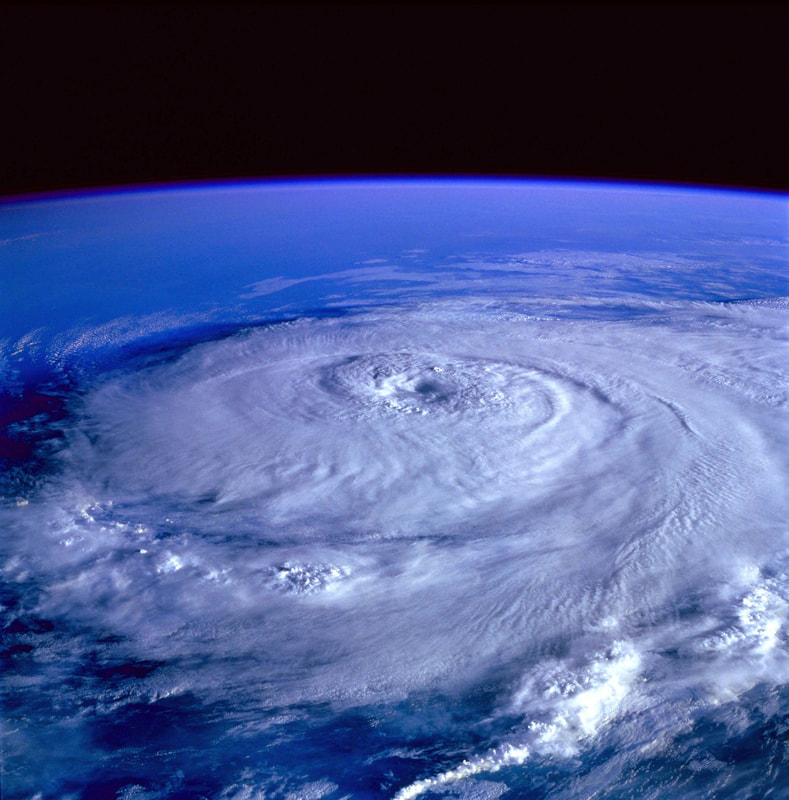

Flood Risks Continue For Many Homeowners

There is no question Texas has been hit hard by Harvey. We are working hard to make sure all insurance claims are settles fairly and quickly. While many work to recover it is a good reminder to consider flood and wind insurance. Your homeowner’s insurance does not cover the risk from flooding. You will need to secure coverage from the National Flood Insurance Program. This program can be secured through our office. More than 60% of the flood insurance claims that the Federal Emergency Management Agency (FEMA) receives are from flood insurance policyholders who have property outside of the mapped 100-year floodplain. In case you have not noticed, flooding is occurring all over the country. In addition, other conditions can alter the flood outlook, including changing climate or the effects of El Nino or La Nina. Our community has continued risks from flooding and we want you to be informed. Many weather experts tell us that if you are in a 100-year floodplain, or live close to waterways, you actually have about a 60% chance each year of having a flood. “The price of insurance through the federal flood insurance program is based on standardized rates and depends on the home's value and whether or not it's in a floodplain. While federal flood insurance pays to rebuild the structure, it only pays current value on possessions. It doesn't cover anything in a basement (other than your heating and air-conditioning system). It doesn't cover living expenses if you have to relocate while your home is being repaired.” Don Griffin, vice president of personal lines for the Property Casualty Insurers Association of America. Quoted at www.bankrate.com Striving for High Levels of Service As our name implies, we strive to make your insurance experience positive. We understand you have many options when it comes to getting personal insurance, so we are going to strive to give you first class customer service you deserve. Business Insurance and Risk

Every business faces risks of various kinds. If you have employees you have the risk of employee injury. You most likely buy workers’ compensation to protect yourself from this risk. No owner or manager wants to believe that their business is exposed to great risks; however, many situations may expose your company to lawsuits, liability and substantial expenses. An unfortunate number of these situations go unnoticed by many business owners until it is too late. Comprehensive risk management is important to the overall success of your business. Unaddressed risks may result in uninsured losses that could potentially cost your business thousands of dollars. Some Important Business Risks to Consider The risk of being sued by employees - There are many state and federal laws that protect worker’s rights. These include harassment, discrimination, retaliation, and civil rights. We can provide you with a quote for employment practices liability insurance that will address many of your employment risks. The risk of lost income - If you have a loss or damage to your building you may not be able to resume operations for a period of time. Your business is at risk for lost revenues. Business income insurance can offer protection. Cyber liability risk - If your business accepts electronic payments, handles sensitive customer information or stores key information on the internet, you are at risk. Cyber liability insurance protects against these risks, and is an important coverage option to explore for many businesses. We Offer a Fresh Perspective to Your Business Risks As part of our service we can review and examine your business operations and help you identify the important business risks. Then we will design a risk and insurance program tailored to meet your needs. The goal of risk management is to protect your business from being vulnerable. Many business risk management and insurance programs focus on keeping the company viable and reducing financial risks. As an Independent Insurance Agency we represent many insurance companies to fit your businesses dynamic needs. Whether you're a new business or a small business, we can help. Being an Independent Agent means we are not only your agent, but we are your insurance broker as well. We understand every business and industry is unique, so we will work with you to find the best business insurance coverage at the lowest rate. Contact us today for a free quote A Personal Insurance Update

We have just witnessed hurricane Harvey, one of the worst disasters in American history. However, we have also seen some great acts of kindness to people in need during the past weeks. Unfortunately, fraud increases also during these events, taking advantage of people in need. As people are looking for help re-building, there will be those who will attempt to take advantage of the situation. If you are recovering from a disaster, here are some things to think about: Prevent Contractor Scams

Some people have already received fraudulent computer calls saying their home insurance has been cancelled and they need to make immediate payment by credit card. Also, be aware of people who say they are adjusters representing your insurance company and you need to pay your deductible now in order to have your claims covered. Call our office if you have any questions regarding your claims. Charity Scams Many scammers are out asking you to donate money to their charity. Make sure you donate to legitimate organizations. Donate money to charities you know, such as The Red Cross or your local church. As an Independent Insurance Agency we represent many insurance companies to fit your businesses dynamic needs. Whether you're a new business or a small business, we can help. Being an Independent Agent means we are not only your agent, but we are your insurance broker as well. We understand every business and industry is unique, so we will work with you to find the best business insurance coverage at the lowest rate. Contact us today for a free quote People are in Harvey recovery mode in Texas, but there will be many people trying to cheat you out of your money. We talk to people every day that have had issues with contractors regarding work performed on their homes. Many people use the internet to search for contractors and end up with trouble. While the internet is not always a bad place to search for contractors, we suggest that you recommend to your clients do a little homework before they sign any agreement.

Striving for High Levels of Service: As our name implies, we strive to make your insurance experience positive. We understand you have many options when it comes to getting personal insurance, so we are going to strive to give you first class customer service you deserve. Strive Insurance Group, Inc. is a full-service independent insurance agency that has been serving the insurance needs of the Dallas area since 1984 (formerly Gordon Lund Insurance). Don't worry, nothing has changed, but our name. In addition to having a presence in the Dallas and North Texas area, we have also expanded to Austin and Central Texas with agent representation and the same professional service. |

Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed

9/28/2017

0 Comments